- Home

- /

Simulate-your-loan-and-start-your-house-hunt-well-prepared

Simulate your loan and start your house hunt well prepared

If you want to buy a house or flat, you have to move fast these days. If you are going to look at a property, it is best to go prepared. You know in advance how much you want to offer, so you can make an offer immediately after your visit. There is no time to hesitate. But how do you know what your maximum bid is?

We are happy to help you simulate your loan.

Fast, faster, fastest

House hunting used to proceed much more slowly. You could go look at a property, sleep on it for a night (or even several), visit the bank quietly to discuss a possible loan, and possibly even visit the property a second time.

Unfortunately, times have changed and it is mostly a matter of being quick.

Quickly find out about the latest properties in your search region, quickly fix a visit and quickly make an offer.

Good preparation is therefore half the battle, especially on the financial front. After all, it makes sense that sellers are more likely to choose prospective buyers who are sure to get a loan, rather than an uncertain offer that might still jump off.

Get a personalised proposal via a loan simulation

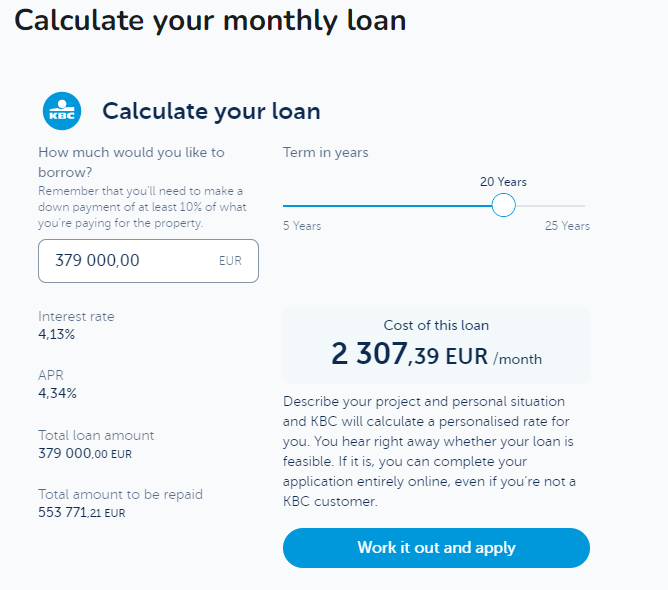

Do you have a property in mind and want to know quickly whether you can handle the monthly repayment? Find out easily via KBC's loan simulation. Fill in all the fields and you get a personalised proposal that tells you how much you can borrow and what this means for your monthly repayments.

You can find this functionality this way on the details page of each property;

(!) Don't forget that in addition to the monthly repayments, you also have to factor in other costs.